Key Takeaways

You may or may not pay property taxes on a mobile or manufactured home.

You may or may not pay property taxes on a mobile or manufactured home.

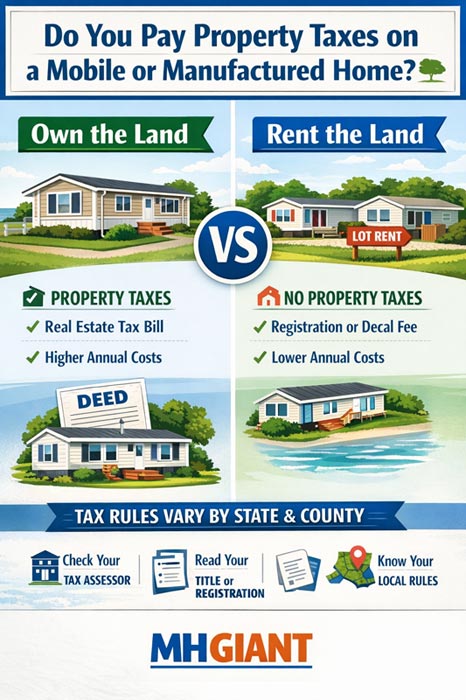

- Own the land? Expect property taxes.

- Rent the land? Likely personal property tax or registration fees instead.

- Rules vary by state and county, so always verify locally.

Understanding how your home is taxed helps you budget better, avoid surprises, and make smarter buying decisions.

Do you pay property taxes on a mobile or manufactured home? Short Answer…

Sometimes. Whether you pay property taxes on a mobile or manufactured home depends on where the home is located, who owns the land, and how the home is legally classified by your state and county.

Some homeowners pay traditional property taxes just like a site-built house. Others pay a smaller personal property tax, registration fee, or no property tax at all.

The Two Ways Mobile & Manufactured Homes Are Taxed

Mobile and manufactured homes are generally taxed in one of two ways:

- As real property (like a house)

- As personal property (similar to a vehicle)

Which one applies makes a big difference in what you pay each year.

When You DO Pay Property Taxes

You will usually pay real estate (property) taxes if your manufactured home meets most or all of the following conditions:

- The home is placed on land you own

- It is permanently installed (often with a foundation or permanent tie-downs)

- Utilities are connected (water, sewer/septic, electric)

- The home’s title has been retired or converted

- The county assessor classifies the home as real property

What This Means

- The home and land are taxed together

- Taxes are assessed annually by the county

- The tax bill may be paid directly or through an escrow if you have a mortgage

- Rates vary widely by state, county, and local tax district

In this setup, a manufactured home is treated much like a traditional single-family home, just at a typically lower assessed value.

When You DO NOT Pay Traditional Property Taxes

You usually do not pay real estate property taxes if your home:

- Is located in a mobile home park

- Sits on leased land

- Still has a title

- Is classified as personal property

Instead, you may pay one or more of the following:

- A personal property tax

- A registration or license fee

- An annual decal or sticker fee

- A vehicle-style tax bill from the state or county

These fees are often much lower than standard property taxes and are common for homes in mobile home communities.

Mobile Home Parks and Lot Rent (Important Distinction)

If you live in a mobile home park:

- The park owner pays property taxes on the land

- You pay lot rent, not property tax

- Lot rent covers land use and often park amenities (roads, clubhouse, trash, etc.)

- Lot rent is not considered a tax and is generally not tax-deductible

Your tax responsibility, if any, is usually limited to your home itself, not the land.

Manufactured Homes vs. Mobile Homes: Does It Matter?

The terminology matters less than classification, but there are some general trends:

- Manufactured homes (built after 1976)

- More likely to be taxed as real property

- Especially when placed on owned land

- Mobile homes (built before 1976)

- More often taxed as personal property

- Common in parks and leased-land communities

That said, either type can fall into either tax category depending on setup and local rules.

What Is the Difference Between a Mobile Home and a Manufactured Home?

How States and Counties Affect Taxes

Property tax rules are state-specific and county-specific. Differences can include:

- How a home is titled

- Whether title retirement is required

- Tax rates and exemptions

- Senior, veteran, or homestead discounts

- Separate assessments for land and home

Two identical homes in different states, or even different counties, can be taxed completely differently.

How to Find Out What YOU Pay

To know exactly how your home is taxed, check:

- County Tax Assessor or Property Appraiser

- Look up your address or parcel number

- Your Home’s Title or Deed

- Determines real vs. personal property

- State DMV or Housing Agency

- Often handles titled manufactured homes

- Your Mobile Home Park Office (if applicable)

- Can explain local rules and fees

If you’re buying, always ask before closing, tax classification can affect affordability and financing.

Common Questions Homeowners Ask

Do manufactured homes have lower property taxes than houses?

Usually yes, because assessed values are typically lower.

Can taxes change if I move the home?

Yes. Moving a home from a park to owned land can change how it’s taxed.

Does owning land always mean property taxes?

Almost always, but exemptions and classifications vary.

Can taxes increase over time?

Yes, due to reassessments, improvements, or local tax rate changes.